IMPS (Immediate Payment Service) or Merchant Payments (P2M – Person-to-merchant) service allows customers to make instant, 24*7, InterBank payments to merchants or enterprises via mobile phone. IMPS enables mobile banking users a facility to make payment to merchants and enterprises, through various access channels such as the Internet, mobile Internet, IVR, SMS, USSD.

The key features of IMPS merchant payments service are as follows:

- Instant InterBank fund transfer.

- The merchant needs to get on-board IMPS network with at least one Bank. The customer of any Bank in the IMPS merchant network can make payment to a merchant through IMPS.

- Convenient and time-saving.

- Anytime, anywhere service.

- Safe & Secure.

- 24*7*365 availability Instant.

- Instant confirmation to sender and receiver.

If you have an active bank account and you wanted to start the IMPS service then you need to be a mobile banking user of their respective Bank. To know about SBI Mobile Banking registration process Click Here

Customer needs to do the follow the following process:

- Register mobile number with the account in the respective Bank.

- Get MMID. MMID stands for Mobile Money Identifier and is a 7-digit number that is provided by Bank to its customers. This number is used to identify the customer’s Bank and linked account number. The combination of mobile number and MMID is unique for the particular account, and a customer can link the same mobile number with multiple accounts in the same Bank, and get separate MMID for each account.

- Get M-PIN. M-PIN is Mobile PIN, a secret password that is provided by Bank to the customers. Customer needs to authenticate transaction using M-PIN.

- Download mobile banking application or use SMS / USSD facility provided by the Bank. In order to perform IMPS transactions, customer needs to download mobile banking application or use SMS / USSD facility provided by the Bank.

- Perform transaction using mobile banking application or SMS / USSD facility.

Note: Transaction charges: Transaction charges Rs. 5 for TXN Amt. up to Rs. 5000/- and Rs. 10 for above.

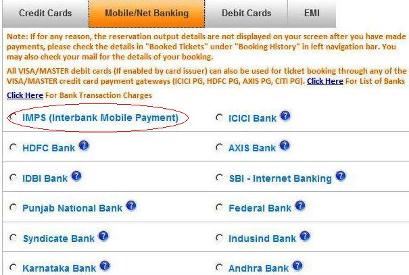

Information regarding participating banks on IMPS?

URL: http://www.npci.org.in/impsmerpay1.aspx

How to register your mobile number and obtain MMID for your respective bank?

URL: http://www.npci.org.in/impsmerpay10.aspx

How to generate OTP for your respective Bank?

URL: http://www.npci.org.in/impsmerpayotp.aspx

For more details about IMPS visit: http://www.npci.org.in/impsmerpay1.aspx